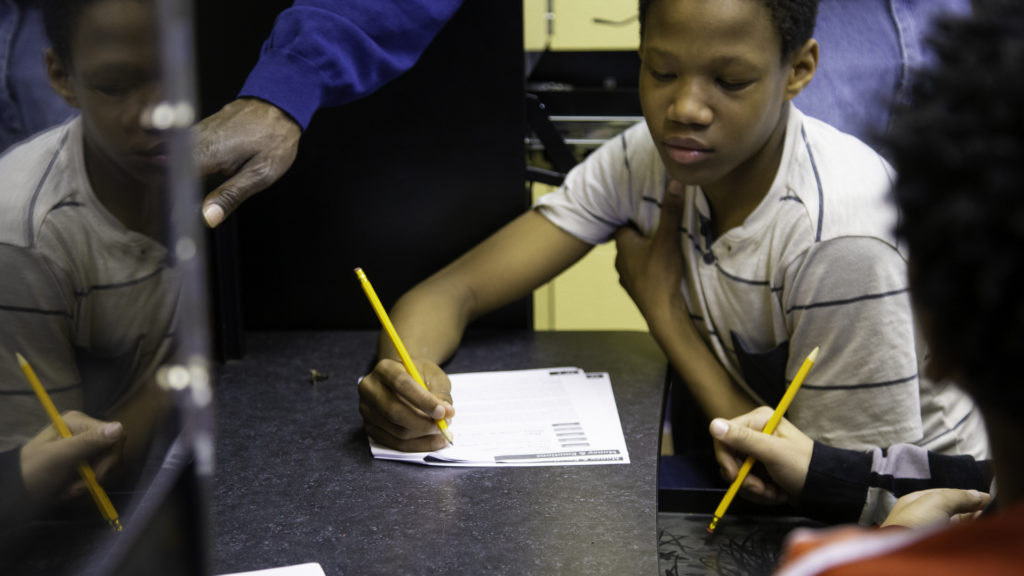

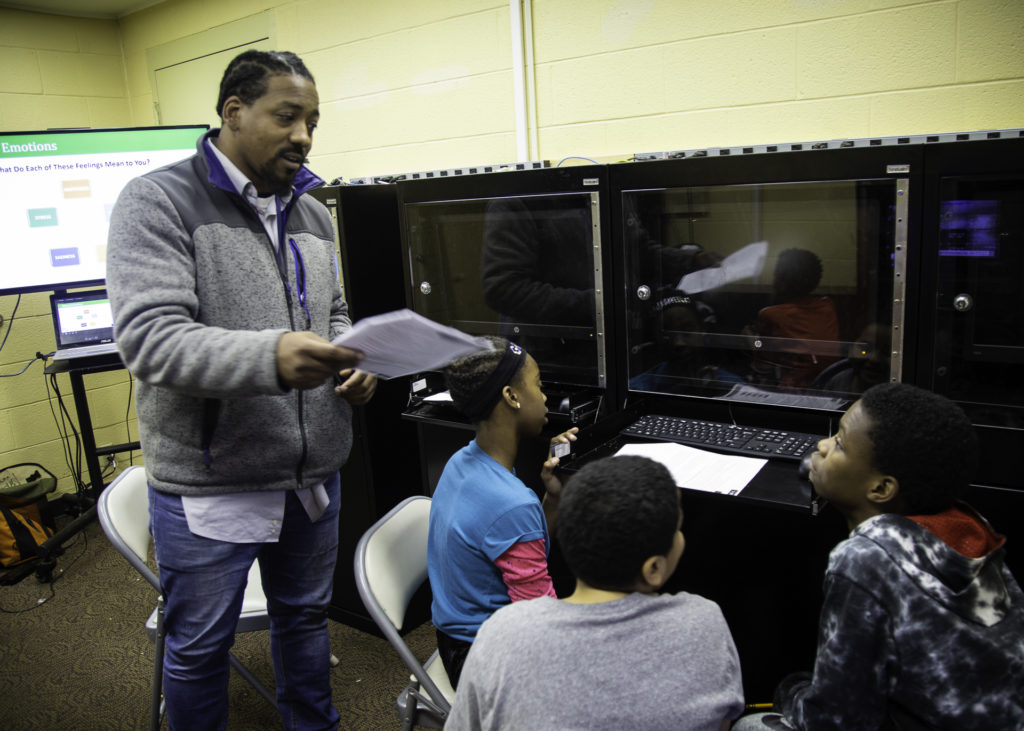

Financial Literacy Boot Camp creates programming for students especially in underserved communities. With our fiscal sponsor and non-profit, Fun Fitness Foundation Inc, we build fun workshops and exercises to teach basics of finance and budgeting to the youth. It is our belief, that it is vital to spread these fundamentals to give families the opportunity to overcome our economic problems.

Fun Fitness Foundation Inc.

RE: Financial Literacy Boot Camp

809 Suncrest Place

Charleston, WV 25303

Research

In 2017–2018 the National youth obesity rates for ages 10-17 was 15.3%, with 21.9% being low poverty by income level. We believe mixing physical fitness and financial literacy among West Virginia’s youth, specifically in a high poverty in Kanawha County, is a strategic way to provide positive outcomes for future generations.

From the data, we can understand that a significant portion of our population is not in a financially secure position – the financial illiteracy problem affects almost everyone and has moved well beyond epidemic proportions.

-

• 39.4% of adults said their families had trouble meeting at least one basic need for food, health care, housing, or utilities last year. Urban Institute Survey as reported by MarketWatch

• Lack of knowledge about personal finance cost Americans over $280 billion in 2017. National Financial Educators Council

• About half of households age 55 and older have no retirement savings (such as in a 401(k) plan or an IRA). Government Accountability Office

• A Career Builder study found 78% of full-time workers said they live paycheck to paycheck; these results are similar to a Charles Schwab study that found 3 out of 5 Americans living paycheck-to-paycheck. CNBC & Charles Schwab

All these facts and conditions have a profound impact on our children and community. “Less well-off children have worse cognitive, social-behavioral and health outcomes in part because they are poorer, not just because low income is correlated with other household and parental characteristics. Low income affects direct measures of children’s well-being and development, including their cognitive ability, achievement and engagement in school, anxiety levels, and behavior.” JRF.ORG

American Psychological Association research shows that stress induced by poverty can have several detrimental effects on a child’s brain development including the atrophy of the hippocampus, the part of the brain responsible for processing emotional memory. Arthur Dobrin, Psychology Today

The greater the financial strength of individuals within a community, the stronger the community. Changes are rapidly occurring that make addressing people’s financial wellness a huge priority. For instance, we can expect higher unemployment rates due to technical displacement, higher tax rates to pay the growing federal debt, and increasing risk of market bubbles collapsing. National Financial Educators Council

Our project is seeking a long-term more permanent solution. Financial problems are straining community resources and increasing the expenses working class people. Now is the time to prepare young people before they mirror bad circumstances previously described. A fundamental part of our mission is to advocate for financial literacy education, get people involved and move them to action.

Testimonials

“Mr. Davis, I wanted to let you know how much I enjoyed the FLBC that was done at our summer program this year. I believe your program is informative, interactive, and basic enough to understand and gain knowledge concerning finances. I truly believe the FLBC had a tremendous impact on our students. I believe they will make wiser choices in their spending when deciding between a want and a need. They have a better understanding of the importance and benefits in saving rather than spending. Because of the different speakers, several of our students have made a commitment to taking responsibility for being a part of making their community better. So yes, this is an awesome program and I look forward to seeing more of what it has to offer our students. Thank You Again”

— Tonya T. Clark, Partnership of African American Churches Collaborative Partners